Program Overview

Microfinance is an innovative strategy for poverty alleviation in developing countries that provides financial services for the economically active poor. Nearly three billion poor people lack access to basic financial services. The best anti-poverty strategies are those that recognize the power that people have to improve their lives. Access to financial services—whether in the form of savings, credit, money transfers or insurance—is a fundamental tool for improving a family’s productive capacity. When poor people have access to financial services, they invest in assets such as sending their children to school, seeking health care and more nutritious food, and building income-earning potential by investing in their own enterprises.

Research and Publications

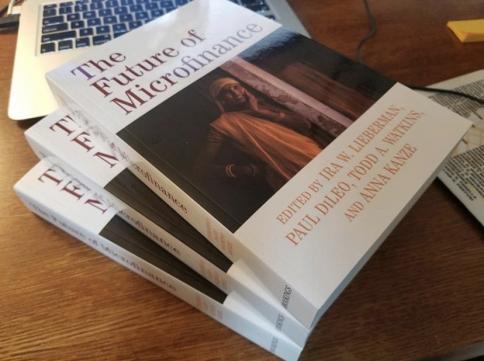

The Program sponsors faculty and student research on the microfinance industry and broader inclusive finance sector. For example, program faculty edited a scholarly volume of articles, published by Emerald Press, “Moving Beyond Storytelling: Emerging Research in Microfinance,” which outlined a multidisciplinary agenda for the field. Included are articles written by Lehigh faculty and other leading microfinance academics and practitioners. Another edited volume, “The Future of Microfinance,” recently published by Brookings Press, was the result of a workshop hosted at Lehigh University by the program. Similarly, Lehigh students collaborated with program faculty in writing “Introduction to Microfinance,” published by World Scientific, The book is the only textbook in the field targeted for undergraduates.

Other Recent Research Publications

- K Manko and TA Watkins, Microfinance and SDG 7: financial impact channels for mitigating energy poverty, Development in Practice, 32(8) 2023.

- TA Watkins, K Nguyen, H Ali, R Gummakonda, J Pelman, and B Taracena, The Impact of Access to Financial Services on Mitigating COVID-19 Mortality Globally, PLOS Global Public Health 3(3), 2022.

- A Eremionkhale and TA Watkins, The Effect of the Global Financial Crisis on the Cost Structure and Double Bottom Line Goal of Microfinance Institutions, International Journal of Business & Management Studies 2(7), 2021.

- TA Watkins, Microfinance Industry Concentration and the Role of Large-Scale and Profitable MFIs, in I Liebermen et al, eds., The Future of Microfinance, Brookings Press, 2020.

- MS German, TA Watkins, M Chowdhury, P Chatterjee, M Rahman, H Seingheng, and AK SenGupta, Evidence of Economically Sustainable Village-Scale Microenterprises for Arsenic Remediation in Developing Countries, Environmental Science and Technology 53(3), 2019.

Blogs and Thought Pieces

- Indian Financial Inclusion during COVID and Recovery: Public Policy to the Rescue

- Client-Centricity Leads the Way in Latin American Inclusive Finance Reponses to COVID-19

- Digitally Reshaping Inclusive Financial Services in the Wake of COVID-19

- Slow-Motion Extinction? Or Can Impact Investors Reinvigorate Pro-Poor Financial Inclusion?

- Rebuilding After COVID: Financial Inclusion Across Asia

- Tracking the Diversification of Microfinance

- Might Microfinance Disempower Women?

- Microcredit Really Does Help the Poor—Just in Modest Ways

- Fintech in Microfinance: In Search of the High-Tech High-Touch Unicorn?

- Can MFIs Deliver What Poor People Need?

- Time to Ditch Impact Investing’s Unproductive Self-Analysis

- Microfinance Is Dead; Long Live Microfinance!

- Microfinance: Revolution or Footnote? The Future of Microfinance Over the Next Ten Years

Workshops and Conferences

The program hosts an ongoing series of workshops in targeted innovation needs areas in microfinance and the broader inclusive finance sector. For example, the Martindale Center co-organized a major international Microfinance industry workshop as a forum for microfinance industry professionals to come together to discuss the future of the industry, and to try to map the way forward (Videos of the workshop here).

The workshop led to the publication of an industry white paper on lessons from the first 40 years of microfinance, written by the four co-organizers (Ira Lieberma, Lipam International, Paul DiLeo and Anna Kanze, Grassroots Capital Management, Todd A. Watkins, Executive Director of the Martindale Center for the Study of Private Enterprise), examining the key questions discussed, and the lessons that can be extracted for microfinance and impact investing, more broadly. The workshop also led to a series of blogs and then to the Brookings Press book, “The Future of Microfinance,” noted above.

Other recent workshop topics have included Financial Inclusion During the Pandemic Crisis: More Relevant Than Ever? (which again led to a series of blogs and policy briefs, included above), management information systems technologies, the evolving research agenda in microfinance, and the prospects for microfinance growth in Africa.

Curriculum

Undergraduate course offered by the Department of Economics each spring—Eco 203, Microfinance (3 credits)

Speaker Series

Interdisciplinary lecture series featuring leading microfinance practitioners and scholars

Field Immersion

This program is a 10-day travel experience visiting microfinance institutions in different global regions. Faculty and students have traveled to Honduras, Peru, Ghana, Cambodia, Zambia and Kenya.

Technology Projects

Teams of students collaborate on innovative technology development projects in partnership with microfinance institutions abroad.

Student Club

Students have a vibrant and active campus organization. Activities include visits to microfinance organizations, fundraising for microfinance institutions in the developing world, assisting local microentrepreneurs to grow their business, and inviting practitioners to share their expertise and best practices on campus.

For more information, please contact Todd A. Watkins.

"The Future of Microfinance"

A Microfinance conference attended by 34 leaders in the sector and hosted by The Martindale Center, Lehigh University 2 years ago has led to the publication of a new book “The Future of Microfinance”.